How to stay on top of things during Tax Season!

It is the final full month before tax day, no pressure right? Well you're not alone in feeling the pressure of the upcoming tax deadline. It is the final push to file your taxes, so here are some tips to help you dominate the tax season!

Eat Healthy Food & Be Hygienic

Now it is difficult to balance time between eating and working. Many folks work so much to the point that they forget to even eat at all. Instead, take some healthy food with you so you can continue to have energy while you power through. Also, don't forget to be hygienic out there, practice daily hygiene to avoid illnesses that'll hinder your progress.

No one wants to scramble all over the place in an attempt to file their taxes last minute. It doesn't end well, you'll stress out whether or not you filed your forms correctly and the IRS will come over you. It is better to have a schedule prepared for yourself so you don't forget things in the back of your mind.

Don't Forget to Ask For Help

If you feel overwhelmed from all of this, remember it's okay to ask for help. You can be up to speed with OneSelfClub in as little as a few days after sign up, then be able to relax knowing that your books will be prepped and don't have to scramble for them. Talk with us today on what else you can do to help you during the tax season. Onward to the final countdown!

Do you remember the era when the first smartphones were constructed, names like Apple and Android are the common names everyone can remember? Though people have forgotten other players who tried following the success of their competitors, and no one else does it better than Microsoft, remember the Windows Phone? Lost in the passing of time, Microsoft tried competing in the mobile market with their phone that had a questionable UI (User Interface), late to the smartphone game, and the lack of popular apps that were available on the phones hurt them and made them lost in time.

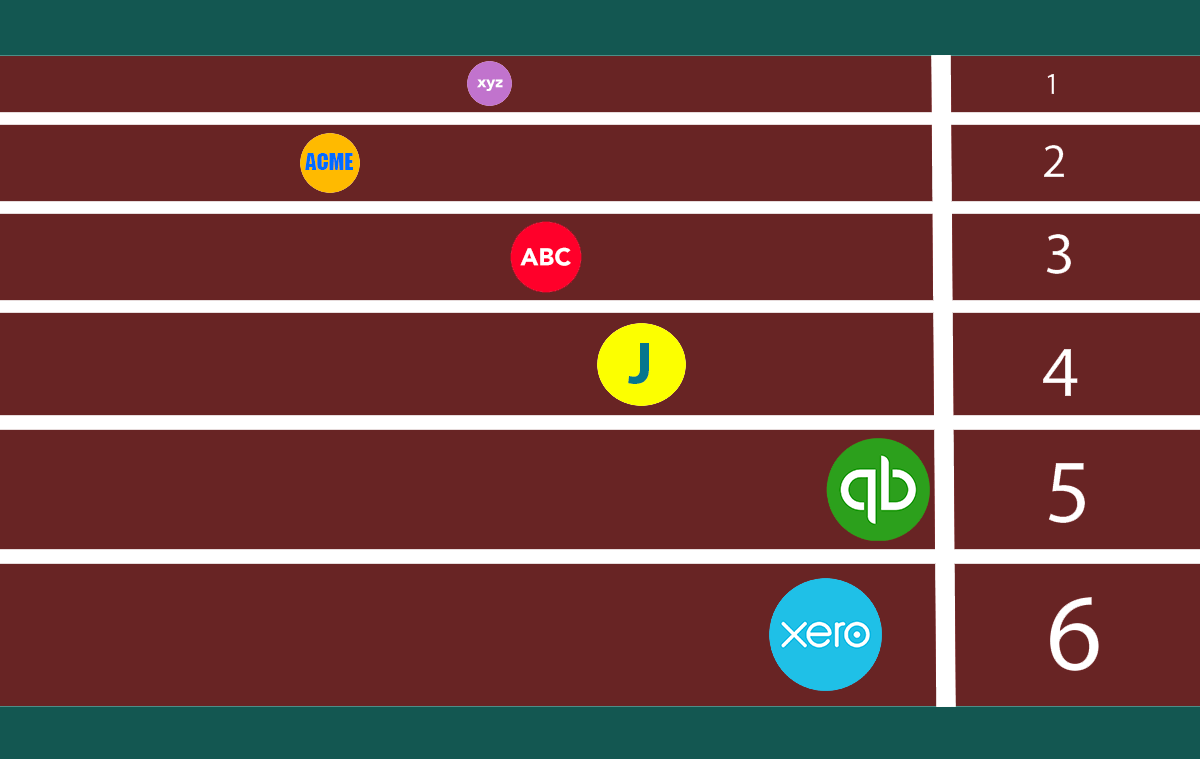

Now, let us look at accounting software. There are so many to choose from it's like we've entered the lottery of picking and figuring out which one suits you best. It could be mind-numbing trying to figure out which one is suitable for a business that is versatile, efficient, and reliable at any given moment. When looking towards the future, we're all going digital and the cloud is the future. There are a few accounting software out there that implement cloud and in this day of age, people don't want something that hasn't been tested fully or properly implemented just because they were "chasing where the money goes".

Xero is probably not a household name in America but they are the first cloud accounting software and are dominate in Asia and Europe. They were founded around 2006, way before the concept of the iPhone was even announced to the public! Now around that time, operating on the cloud was a foreign concept to everyone, and considering that time period, the majority of the people were not fully integrated to the internet as we are now today. So they've been developing and perfecting this for the past 10+ years, which means they have been testing and mastering their program so it's efficient, accurate, and accessible to everyone.

Xero's UI design is seamless, easy on the eyes, and user friendly compared to their competitors in contrast. The fact that it is easy to navigate means that everyone who hasn't used it before can easily pick it up and use it with no problem compared to their competitors whom you would have to call up their hotline services, wait on hold for an hour or so, and then spend another hour trying to figure out how to overcome your technical difficulty.

Now everyone is always on the go traveling to meet with clients, their next gig, seminar, or casually going out for a stroll. We're connected to our phones as we travel, as we always want updates on things we prioritize in our daily lives. People will often stick with social media to get all of their updates from news, friends, shows, sports, etc. When it comes to accounting there are a few that do that moderately well, while some only tell you to select topics like Cash Flow only, Xero has an option where you can create your own personalized reports that you can access anytime without the limitations of the app itself. Their phone app is a robust and seamless experience where you can actually access your P&L at a glance, create invoices & take pictures of receipts to create actions, and so much more! With so much versatility, anyone who is a business owner could use this to help their business get accurate, timely data to make business decisions that matter.

At OneSelfClub, we are strong believers of the cloud and services that help business owners like you to do their everyday tasks. Now that we're partnered up with Xero, we'll make sure you receive a robust system that is accurate and reliable so you're in control of their finances and know your numbers instantly. We believe in the best so we can provide you with the best.

The best accounting software for small businesses should be affordable, easy to use, and allows you to easily track your income and expenses. The software should also include detailed financial statements to give you insights into the health of your business. We looked at over a dozen products and narrowed it down to two powerful ones, QuickBooks and Xero. There were a couple runners up (Zoho & FreshBooks), but QuickBooks and Xero took the cake by a long stretch! Below we will go over 8 reasons why QuickBooks and Xero are the best tools for your business compared to some proprietary product with minimal capabilities and integrations.

1. Integration Capabilities with Multiple Third-Party Apps

The ability to integrate with other programs is a big advantage of QuickBooks and Xero. Both integrate with financial institutions so that your bank and credit card transactions can automatically download daily to your accounting software. Additionally, both apps integrate with hundreds of other apps that you may already be using, such as, Insightly, EpicLedger, CRM, Stripe, PayPal, Shopify, Square, etc. If your app does not have integration capabilities, automating your accounting process will be impossible. This will end up costing you in more ways than one. You will end up spending more time and effort manually entering information and keeping up with physical documents, which will end up costing you money.

2. Easily Give Access to Your Bookkeeping Data When Your Switch Accountant

With established apps like QuickBooks and Xero, there is no need to transfer data from one accountant to another. For whatever reason, if you ever decide to switch accountant or CPA, all you have to do is give access to your next accountant or CPA via the administrator portal. This will save you money because your next accountant won’t have to spend hours recreating your data all over again which you will be billed for.

3. Mobile Device Compatibility

One of the most convenient factors about Xero and QuickBooks is that they are making it available on mobile devices. Users can manage their customers, invoices, estimates and expenses on the go.

4. Easy to Setup & Use

One problem with accounting programs is that many of them are difficult to use and cumbersome to learn because they don’t have a mature customer base which means limited feedback to optimize the programs. QuickBooks, on the other hand, is designed to be intuitive and easy to understand, even for business owners who lack an accounting or financial background. Xero has a great team of staff who are always on standby via email to help you figure out the ins and outs of the program. It also has detailed tutorials for specific scenarios.

5. Top-Notch Support

QuickBooks and Xero provide incredible support. You get free phone support and access to online tutorial videos and online support forums. The best thing, their response time is immediate.

With other apps on the market, they are not as responsive when it comes to support. Their turnaround times are questionable. What if you had an emergency and you need to take immediate action? Let’s just say you will be waiting a long time to receive any sort of feedback or help.

6. Top Level Security

QuickBooks relies on advanced, industry-recognized security safeguards to keep all of your financial data private and protected. QuickBooks Online is a VeriSigned Secured product. VeriSign is a leading secure socket layer (SSL) Certificate Authority. With pass-word-protected login, firewall protected servers and the same encryption technology (128 bit SSL) used by the world’s top banks, QuickBooks has the security element in place to give you peace of mind.

With Xero, your business and personal information is encrypted and replicated it in several locations online. This means that your data is safe, secure and available when you need it. It also has a two-step authentication which adds an extra layer of security. Each time you log in, you will be required to enter a unique code generated by an app on your smartphone making it harder for anyone to hack into your account.

Would you use an app, that hasn’t been around for long, with dubious security? We think not! With Xero and QuickBooks, your business and personal information is secure.

7. Detailed Reports

By managing all of your cash inflow and outflow activities in QuickBooks and Xero, you are able to access several reports that provide valuable insights into your business. All reports are pre-built in both software and can be run easily generated. Reports are updated in real-time as you enter and save transactions. In addition to AR and AP reports, you can also run top three reports that you need in order to assess the overall health of your business: Profit and Loss, Balance Sheet and Cash Flow Statements.

8. Stability & Reliability

Software bugs are frustrating and at any instance something can go wrong causing you to lose all your hard work and information. This is where Xero and QuickBooks shine. Since both software have been around for so long, their engineers have gone through a fair share of fixes and eliminating bugs making the software extremely stable. Other proprietary accounting applications are still going through a trial and error process and you never know when your data will be wiped by a bug or a program error. You can always rely on QuickBooks and Xero!

Of course, there are more than eight reasons why Xero and QuickBooks take the cake, but we thought we’d keep it short and only highlight the more relevant features. After reading this article, we hope to have helped you determine which accounting software is right for you.

Why We Went with QuickBooks As Part of Our Accounting Package

At OneSelfClub we pride ourselves in providing our members the best tools for their business needs and that’s why we use QuickBooks as part of our complete accounting package. QuickBooks is easy to use, reliable, convenient, hassle-free and it is universal. Our package includes QuickBooks Online because we believe it’s the best solution for business owners. It’s cloud-based so that you never lose your financial data, it’s affordable, it’s easy to use and it’s available on all of your devices.

With QuickBooks Online, business owners can:

· Send invoices

· Create and evaluate financial reports

· Track expenses

· Generate profit and loss statements

· Bank reconciliation

· Inventory tracking

· Track accounts payable

· Create and manage budgets

· And the list goes on…

QuickBooks Online is just a tool that helps you maintain your company’s day-to-day finances, but what about your other accounting needs? Well, OneSelfClub has the complete solution. It is comprehensive and everything you need for your business accounting needs. In addition to the QuickBooks Online subscription, as a OneSelfClub member, you will also get:

· Bookkeeping Service

· Month-end Reconciliation

· 1-hour interaction with an accounting advisor

· EpicLedger financial dashboard to help you understand your numbers in less than 60 seconds.

· EpicMileage to automatically track your business miles and claim maximum deduction during tax time.

To find out more or to take advantage of our complete accounting solution call us at 346-291-6286 or email us at

Using DIY accounting methods like QuickBooks as a start up or small business owner is expected. No matter how diligent you were in recording your finances, chances are some things fall through the cracks.

Messy Chart of Accounts

Your chart of accounts should be clean and easy to understand. If it's too complicated, it’s inevitable that items will get coded wrong. Don’t create a million hyper-specific accounts. And remember to group similar accounts together. Basing your chart of accounts on Schedule C (Form 1040) is a good place to start.

Double Entries

This happens a lot, even to the best of us. Having the same entries in two places will cause your books to be unbalanced and you will waste time fixing the error or pay your CPA to look for and solve the issue. Create a system to track your entries. For example, have two folders, "not entered" and "entered". Once you have entered your transactions into QuickBooks, move them over to the "entered" folder.

Using Accrual Instead of Cash-based Accounting

QuickBooks defaults to the accrual method, but it's better to use the cash-based method. It's effortless, tells you exactly when the transaction took place, and it's easier to see how much cash you have at any given time.

Missing Transactions

Many of us fall behind on our records and catching up is a major hassle. To stay current on your records, make a habit of regularly recording your transactions and not waiting till the last minute. Transaction Thursdays is a perfect day!

Missing or Incorrect Adjustments

Let's say you charge $50 for a service, and the credit card company takes 2%, your revenue is actually $49. Make sure you have corrected your adjustments at the end of the month, quarter or year.

Losing Old Records

If you have changed accounting software or (for some reason) shut your business down along with your QuickBooks, remember that you only have a read-only access to your QuickBooks files. Make sure to backup regularly.

Not Getting Help

Feeling overwhelmed or stressed? Especially with the tax deadline approaching? It might be time to sign up with OneSelfClub. OneSelfClub is the perfect accounting solution for start-ups and small business owners like you. It's affordable, interactive, reliable and a lot less stressful than paying a CPA to clean up your mess nearing tax season.

Gather Your Receipts

Saving your receipts can be a tedious task, but it's important. You should save all your receipts and invoices related to your business expenditures. Here are some different types of receipts you will need to gather: vendor invoices, statements and check payments made.

Reconcile Your Bank Accounts

Monthly bank reconciliation is crucial to ensure accuracy of financial statements. During the reconciliation process, steps need to be taken to ensure each transaction from your bank statement matches with your books. Identify and fix any discrepancies to ensure that your bank and credit card balances are properly reconciled.

Separate Personal Expenses From Business Expenses

We can't stress this enough. Commingling your personal and business expenses in the same account will raise red flags and result in you being held personally liable for your business’s debt and actions.

Go Green

Going green will guarantee that you don't spend extraordinary amount of time compiling your information and it's better for the environment. It will also make your life easier. We recommend you use tools like Shoeboxed to scan/document your receipts. And, it will automatically create expense reports from your uploads.

Collect W-2s and 1099s

If you hire employees or contractors, you are required to file W2s and 1099s. The deadline for filing these reports is due by January 31, 2019. Late filing may result in penalties, so as a business owner, you definitely want to be sure to stay in compliance.

Have A Tax Professional Review Your Expenses

We understand some business owners prefer the DYI approach when it comes to accounting and filing taxes. However, we strongly advise that you hire an experienced CPA to review your books, tax deductions, and any other financial information relevant to your tax return, before you file your taxes. This helps to eliminate errors and ensures that you're taking advantage of all the deductions available to you and your business.

Frustrated with doing your own books? Sign up for OneSelfClub.