If You are running a business, regardless of size, you instinctively know how important accounting is to long-term success. The challenge is finding the right medium, an accounting application that works for your unique situation. Majority of small business owners use either QuickBooks Online or QuickBooks Self-Employed. The difference between the two is significant and whether you use one or the other is solely dependent on the type of business you are operating. Let's look at each option in its entirety.

What is QuickBooks Self-Employed & Who Is It Best Suited For

As you have probably guessed, QuickBooks Self-Employed is for the self-employed. More specifically, it's for independent contractors who need a little help staying organized. By independent, we mean just about any part-timer, moonlighter, momprenuer, freelancer, real estate agent, Uber/Lyft driver or independent consultant. Additionally, if you sell products via e-commerce platform, QuickBooks Self-Employed can help you stay organized.

Ideally, it's for those business owners who don't differentiate between personal and business bank accounts, i.e. people who file 1040s. If you have one account that stores all of your income and expense, QuickBooks Self-Employed can help you sort it out.

More specifically, QuickBooks Self-Employed is for individuals who:

- File a Schedule C with Form 1040

- Pay majority of expenses using their personal debit card, credit card or even cash

- Write no more than 5 checks per month

- Invoice no more than 10 customers per month

- Do not have employees as QuickBooks Self-Employed does not have payroll functionality

- Do not employ any contractors

- Want to pay for the tool on a month-to-month basis

What is QuickBooks Online & Who Should Use It

QuickBooks Online is ideal if you are a solopreneur or a small to medium-sized service-based business that requires inventory tracking options or have invoicing requirements. It is a great option if you intend to grow or scale your business in the upcoming years, possibly hiring employees or if you sell goods or products (online or physically).

It is also a great option for companies that want multiple directors to access financial data or for those who desire automatic updates from the cloud.

In general, QuickBooks Online will work for individuals or businesses that:

- Buy or sell products or services, similar to a retail establishment

- Manage accounts payable & accounts receivable

- Plan to expand in the future and will have employees who work for them

- Pay or plan to pay employees or contractors

- Require extensive reports about their business

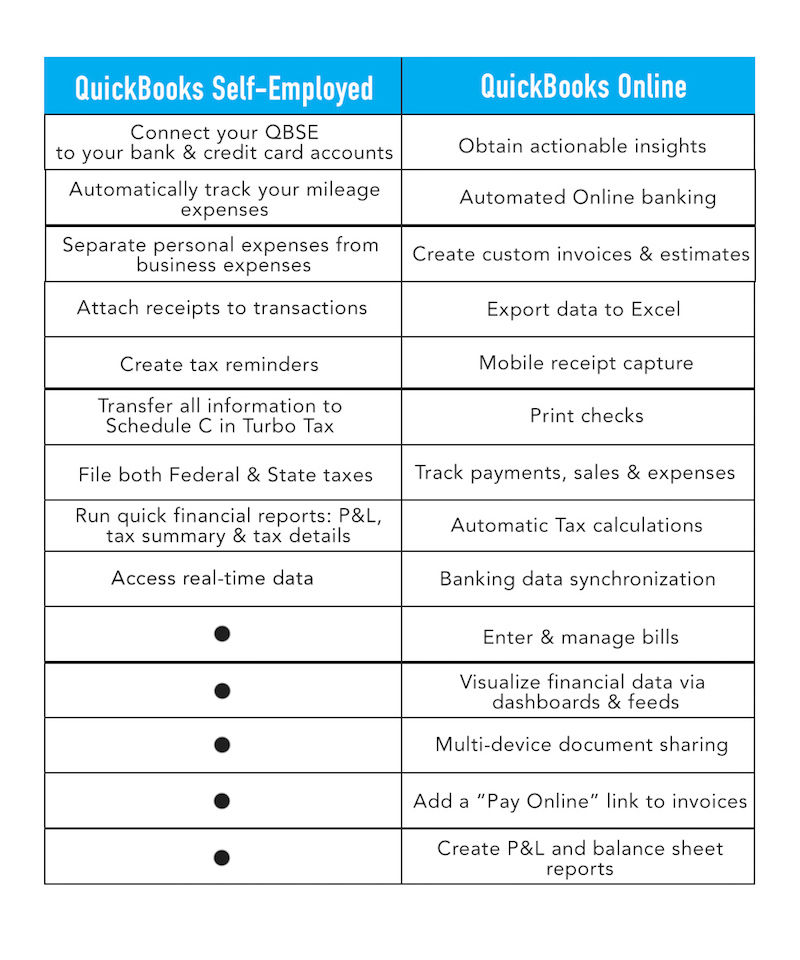

Now that you know who QuickBooks Self-Employed and QuickBooks Online is suited for, let's get in to the nitty-gritty of each. Both programs are impressive, but only one will fit your needs. A summary of key features will help you clarify which program is best suited for you:

What Can You Do With QuickBooks Self-Employed & QuickBooks Online (Features)

The goal of QuickBooks Self-Employed is to track freelance business income and expense, capture all expense deductions for tax time, estimate quarterly tax payments and make tax time really simple and stress-free. On the other hand, the goal of QuickBooks Online is to manage the financial aspects of a business. Below are some key features of each QuickBooks:

What Is Missing From Each QuickBooks Solution

There are obviously some things missing between QuickBooks Self-Employed and QuickBooks Online. With QuickBooks Self-Employed, you are limited to the reports you pull, i.e. profit and loss statement and a Schedule C report. You cant send invoices or receipts and the Mileage tracking feature doesn't work all that great on iOS devices. QuickBooks Online on the other hand, is not for beginners; there's a definite learning curve and it requires time and patience.

Additionally, unlike QuickBooks Self-Employed, Quickbooks Online does not include a mileage tracker. If you are self-employed, tracking your miles is important so that you can claim maximum mileage deduction when it's tax time. On average, business owners can save $5000 on taxes with just mileage deduction alone.

The Alternative & Complete Accounting Solution For Your Business

Even though both solutions are sufficient and will satisfy your accounting needs, neither QuickBooks Online nor QuickBooks Self-Employed is the complete solution. OneSelfClub has the complete solution for your business needs. Since QuickBooks Online doesn't have mileage tracking, OneSelfClub's accounting package has filled that void by offering EpicMileage, a free mileage tracking app that automatically tracks the miles you drive.

On top of that, you get your own accounting advisor to consult when you have questions or concerns which both QuickBooks are missing. The package also includes EpicLedger's financial dashboard which will make your life easier when it comes to understanding your numbers and making timely business decisions. Highlighted below are all the accounting services included in the OneSelfClub package:

OneSelfClub Accounting Package - What's Included

- Bookkeeping service

- Month-end reconciliations

- 1-hour interaction with an accounting advisor

- EpicMileage - mileage tracker app

- EpicLedger financial dashboard - Know your numbers in 60 seconds!

- QuickBooks Online

To see if OneSelfClub is right for your business, call 713-804-7190 or email

Some small business owners love going over their own books — after all, it’s their personal scorecard of how well the business is doing. Others dread dealing with numbers or get so caught up in day-to-day operations that they neglect their bookkeeping. Whether you love it or hate it, good bookkeeping is essential to small business success.

Separate Your Personal and Business Finances

When your business is just starting out, it is easy to mix and mingle expenses and income. Co-mingling business and personal money can lead to big tax headaches down the road. Open a business bank account as soon as you have formed your business entity. It is also a good idea to get a business credit card as soon as possible. Using a business credit card responsibly helps your business build its credit rating separate from your personal credit rating.

Do A Weekly Checkup

If you are not a numbers person, your natural tendency may be to put off the "boring" part of entrepreneurship as long as you can. Then, you could end up with books that are not balanced, bounced checks or unpaid invoices that are months overdue. Make sure to review your books at least once a week. It will help ensure everything is in great shape.

Get Professional Help With Your Bookkeeping

If you are the business owner also doubling as the office administrator/bookkeeper and finding the bookkeeping too hard or don't have enough time to do it, then we recommend hiring a professional. Hiring a professional is cost-effective and more importantly, it will save you time to focus on growing your business.

Track and Document Business Expenses

With changes to business tax reporting for 2019, you should consult your accountant to see what kinds of expenses you will be able to deduct next year. Be sure to keep detailed records, including receipts. Avoid having drawers stuffed full of receipts by scanning and digitizing them; there are several smartphone apps that make this easy. Avoid using cash for business expenses. Using your business credit card is a good way to simplify your expense tracking, because most business credit cards sort your expenses by categories.

Stay on Top of Your Business’ Accounts Receivable

Late-paying customers can quickly dry up your business’ cash flow. That’s why it is essential to pay attention to when your receivables are due and act immediately when they are overdue. Reach out to late-paying customers right away to see what’s going on with their payment and when you can expect to receive the money. If the customer is having financial difficulties, see if you can work out a payment plan to start getting some of the money that is owed to you.

Automate Whenever Possible

Bookkeeping software simplifies the tedious process of entering data into spreadsheets and reconciling figures manually. Cloud-based bookkeeping software are even better because they back up all your data — no more worries about a crashed hard drive wiping out your books. This is why we use QuickBooks Online and EpicLedger. Both are cloud-based softwares that eliminate the possibility of losing important data. Everything is in the cloud.

Stay On Top Of Tax Deadlines

In order to avoid getting caught short, plan ahead. Set aside money for any anticipated tax bills and pay them on time so you don’t face penalties. The IRS website’s tax calendar for businesses can sync with your own cloud-based calendar so you never miss a deadline.

Avoid Using Cash For Business Expenses

Instead, use your debit or credit card religiously. When you use cash, you lose track of potential write-offs. If you must pull money out of the ATM, write a note on the receipt stating the purpose of the withdrawal.

Learn To Understand Monthly Bookkeeping Reports

It’s surprising how many business owners have no clue if what they are doing is working until it’s too late i.e. they suddenly find themselves with low cash flow and huge debts. To avoid this, you must understand your bookkeeping reports such as, income statements, balance sheets, cash flow statements, etc. With OneSelfClub you get a monthly financial meeting with an advisor to review these reports and your financials in detail. This is a crucial step to have someone consult with you about your financials as they can help you understand the trend of how your business is doing, and provide another point of view on your financials. Additionally, you can use this time to go over additional questions or concerns you may have on a monthly basis instead of having to clean up everything year end to file your taxes.

Perform Quarterly Reviews

Each quarter, take an in-depth look at your bookkeeping and accounting records. Look for trends, such as growing or declining sales, year-over-year revenues, or an increase in late-paying customers. Consult your accountant so that they can help you look at the big picture so you’re better prepared for future capital needs such as buying new equipment or moving to a bigger location. Additionally, you can use financial dashboards to perform quick yet thorough reviews.

Plan For Major Expenses

Set aside money for major expenses like furniture, new equipment, repairs, etc. Proper bookkeeping is important and it can help you budget for your business. By budgeting for your small business in the coming years, you can save a lot of worry about dealing with these expenses in the future.

Have Immediate Access To Your Financial Data

If you don't have access to your financial data, it becomes exponentially difficult to make business decisions or analyze the health of your business when you need to most. Think about driving your car at night without headlights - you are bound to crash. No matter where you are in your business’ journey, immediate access to critical information like cash flow, revenue, net profit margin, expenses, etc. will allow you to make smarter choices. EpicLedger is a great tool that allows business owners to easily access their financial data no matter the time or location.

Let OneSelfClub help you with your bookkeeping needs. Sign up today or email us at

As a small business or a start-up, you've probably resorted to hiring a bookkeeper because they're inexpensive. This is perfectly fine as start-ups and small businesses don’t have complex financials. However, even if you were sold on hiring an “affordable” bookkeeper, chances are you are not sure what you are paying for. Here’s why:

Manual Work.

Most bookkeepers bring experience but experience doesn’t mean efficiency. A bookkeeper may have 10+ years under their belt, but if they are applying manual work they are not efficient. Manual work are time-consuming and error-prone therefore, more expensive.

What Are You Missing Out?

Have you ever wondered how is your business performing? What is your current financial position? While most bookkeepers helps maintain your books, you don’t really know how to read financial statements to make critical business decision to maintain and grow your business.

Money Out the Door!

Not knowing your numbers may be costing your more than your realize. Bookkeeping services focuses on recording raw data but have you given some thoughts about how can those data help you save costs, maximize tax savings and increase profits. Imagine if there is a technology that transforms these raw data into important, easy to understand information to assist you in optimizing your business financials.

For small businesses and start-ups, the perfect solution is to find an all-in-one accounting solution like OneSelfClub. OneSelfClub utilizes technology to automate your business so that you can increase profits, minimize costs and grow your business. Here’s what’s included:

1. Bookkeeping Services

2. 1 Hour Interaction with a Professional Accountant

3. Month-end Reconciliation

4. Quickbooks Online Subscription

5. EpicLedger Financial Dashboard (read your numbers in 60 seconds!)

6. EpicMileage (automatically track your business miles)

For many people, tax season can be a mad scramble full of document-hunting, form-filling, nail-biting and yelling. But it does not have to be. Starting your tax prep well before the deadline can make your life way less chaotic—especially if you own a business and plan to claim deductions.

In order to be well-prepared for the next tax season, it is essential to have good transactional data. To achieve this your books must be in order! Follow our guide to getting your business ready for tax season:

Make Sure All Transactions Are Recorded Properly

Messing up your taxes because of missing or erroneous transactions can be stressful, but it can be easily avoided. Make sure you are recording all of your business transactions in your general ledger, and that you are categorizing each transaction as accurately and consistently as you can. This will help you maximize your deductions. For example, if you recorded your website hosting under "Advertising" one month, do not record it as "Investment" the next month. Make sure you are consistent.

Know Your Numbers

Knowing your numbers will help you understand your financial position, this includes your expenses, profit, revenue, net profit margin, cash flow, etc. It will better prepare you for tax planning and strategize for some tax-saving opportunities that way you are not caught off guard and have to pay the IRS an arm and a leg.

Reconcile Your Bank & Credit Card Accounts

"Reconciling" is just a complicated word for "make sure your books match your bank accounts". Your bookkeeping is incomplete until you have checked it against all of your statements. By reconciling you can save yourself the trouble when it comes time to filing your taxes.

Hiring The Right Accounting Professional

Doing everything yourself can be a great way to save money, but we strongly advise that you have an experienced accountant to take a look at your books. Don't just hire a professional for the sake of hiring them. Make sure that the person you hire knows what they are talking about. The right accountant will make sure you are set up properly, that you are taking advantage of the right year-end tax moves, and that your business is in good shape for tax season.

Let OneSelfClub get your books tax-ready! Sign up today and skip the stress and chaos and let us handle your bookkeeping for you.

For more information, email